Examining the concept of entrepreneurial spirit, persistence and the predatory obsession

I’ve spent a lot of time, talking to colleagues in the field — designers, brand people, consultants, architects, engineers, bankers and financiers, real estate directors, others in the business of survival — some, to the nature of the struggle, are optimistic, ever looking upward. Others seem to be looking more horizontally, engaging in tactics that are surprisingly short-sighted and self serving, even to the degree of permanently damaging their reputations. The strategy would seem to be more about the quick nab, at whatever cost, to string out the business. It is their personal saga of survival, to each their own.

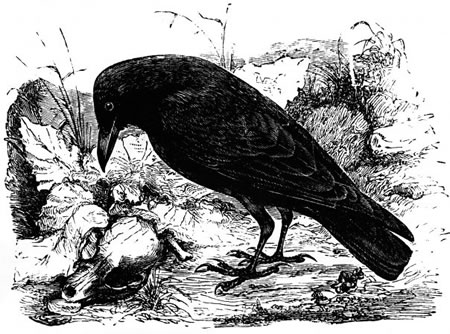

According to a recent study “From Predators to Icons,” the French scholars Michel Villette and Chatherine Vuillermot examined what successful entrepreneurs have in common — what drives them, what’s the nature of their success; how did they get there. Their journals present case histories of businessmen who built their own empires—, wildly ranging from Sam Walton of Wal-Mart, to Bernard Arnault, of the luxury-goods conglomerate L.V.M.H.—and set the cartography what they consider the purposeful linear course of a successful entrepreneur’s career. A stridently successful businessman, in Villette and Vuillermot’s overview, is anything but a inventively inspired risk-taker. He is instead, to their analyses, a predator. And predators seek to “rearrange” assets from assessment to interpretation, from strategy to a kind of near coercion, to incur the least risk possible while hunting. And, in hunting, the idea of survival — in predation — is to not “be the hunted.” To the source of our own inspiration for successful entrepreneurial types –“would we so revere risk-taking if we realized that the people who are supposedly taking bold risks in the cause of entrepreneurship are actually doing no such thing?”

Malcolm Gladwell has proposed an intriguing (as ever) framing of this theory — the idea of the entrepreneur as obsessively risk averse. While the spirit of some leading business luminaries might suggest spectacular adventure and sheer risk-making folly and exposure. To his overview of the predatory entrepreneurial positioning, his cites:

“There is almost always, they conclude, a moment of great capital accumulation — a particular transaction that catapults him into prominence. The entrepreneur has access to that deal by virtue of occupying a “structural hole,” a niche that gives him a unique perspective on a particular market.”

Villette and Vuillermot go on, “The businessman looks for partners to a transaction who do not have the same definition as he of the value of the goods exchanged, that is, who undervalue what they buy from him in comparison to his own evaluation.” He moves decisively. He repeats the good deal over and over again, until the opportunity closes, and — most crucially — his focus throughout that sequence is on hedging his bets and minimizing his chances of failure. The truly successful businessman, is anything but a risk-taker. He is a predator, and predators seek to incur the least risk possible while hunting.

In studying and contemplating the businessmen and investors who have had extraordinary success, they all seem to exhibit this trait — looking for leveraged openings — “holes” as Gladwell calls them. Most great businesses occupy a space in their industry where they are protected by the shielding crevasse of their competitive advantages. And typically, it is a result of growing and growing until you almost monopolize your sector. But, beyond that, the idea of forms of support, the legacy of business building is often times the nature of how that foundation came to be — money, as a supporting factor to launch the strategies of the “predatory entrepreneur. That is — starting with something.

Utilizing research from economist Scott Shane, Gladwell delves into the notion that the entrepreneur is a risk taker and gives reasons for why entrepreneurs fail:

“…many entrepreneurs take plenty of risks — but those are generally the failed entrepreneurs, not the success stories. The failures violate all kinds of established principles of new-business formation. New-business success is clearly correlated with the size of initial capitalization. But failed entrepreneurs tend to be wildly undercapitalized. The data show that organizing as a corporation is best. But failed entrepreneurs tend to organize as sole proprietorships. Writing a business plan is a must; failed entrepreneurs rarely take that step. Taking over an existing business is always the best bet; failed entrepreneurs prefer to start from scratch. Ninety per cent of the fastest-growing companies in the country sell to other businesses; failed entrepreneurs try selling to consumers, and, rather than serving customers that other businesses have missed, they chase the same people as their competitors do. The list goes on: they undermine marketing; they don’t understand the importance of financial controls; they try to compete on price. Shane concedes that some of these risks are unavoidable: would-be entrepreneurs take them because they have no choice. But a good many of these risks reflect a lack of preparation or foresight.”

The concept of failure — might seem counter intuitive to a person who is exploring the idea of a start up business enterprise. A entrepreneurial originator may balk at the prospect of taking over an existing business, but if it is a forced sale due to owner’s personal challenges or decisions to change life direction, an initiating entrepreneur may have the opportunity to acquire an excellent transformative business at a low price. Strategies like these require the entrepreneur to employ a folio of rational judgment that is completely counter to the cowboy image that the media promulgates.

What about the notion of reputation? Gladwell notes “that many successful entrepreneurs are willing to risk their personal reputation for their business. He contrasts the behavior of banking CEOs who kept piling up bad investments because they feared standing out from the crowd. On the contrary, he notes Sam Walton’s decision to seek financing from his in-laws a second time after failing at his first venture.”

What about risk — and the financing their business ventures:

“Giovanni Agnelli, the founder of Fiat, financed his young company with the money of investors — who were “subsequently excluded from the company by a maneuver by Agnelli,” the authors point out. Bernard Arnault took over the Bousac group at a personal cost of forty million francs, which was a “fraction of the immediate resale value of the assets.” The French industrialist Vincent Bollore “took charge of the failing family company for almost nothing with other people’s money.” George Estman, the founder of Kodak, shifted the financial risk of his new enterprise to his family and to his wealthy friend Henry Strong.”

According to Tariq Ali’s the Street Capitalist, “For the entrepreneur, cheap and secure financing can drastically improve the chances of an enterprise’s survival. By investing little of his own money, the entrepreneur can amplify returns on his own invested capital while keeping dry powder in reserve for new opportunities. Most successful real estate developers exhibit the same trait as do private equity firms, little equity is actually invested in the properties acquired in favor of debt. This often leaves the newly privatized properties in danger of default in the case of a sudden economic downturn, while keeping the fortunes of the owners largely intact.”

Hardly risk. Hardly adventuresome. But the thread continues…In my experience — working with investors — ultimately, it comes to passion. And the engagement. It might be pointed out that the foundations of Ted Turner’s enterprise were largely founded on the legacy of his father — who, after all, committed suicide after he sold out of his advertising franchise that formed the bedrock of Turner’s own empire. That speaks, perhaps, the power of the legacy of commitment and passion — being in, being connected to the game. Once that game is over — is it truly over?

Giving, sharing, growing, evolving, forming passionate links to community — and the risk of invention; I wonder if the cowboy nature of what might be defined as the high-powered entrepreneur is really as engaging as one might presume? I frame this: that entrepreneurial action is fundamentally — even to the 15c use of the word — an action undertaken, a mission, a voyage; and it’s less, perhaps, to the sheer win of cash and acquisition, but the spirit in which it’s taken, under adventure. That any venture can be praised in the intention of that act — even in the collapse of failure, learnings resume.

And everything we do is about learning and advancement on that foundation. Greatness of intention shall not dissolve in time. Cash will.

tsg | san francisco

….

the reels: http://www.youtube.com/user/GIRVIN888

girvin blogs:

http://blog.girvin.com/

https://tim.girvin.com/index.php

girvin profiles and communities:

TED: http://www.ted.com/index.php/profiles/view/id/825

Behance: http://www.behance.net/GIRVIN-Branding

Flickr: http://www.flickr.com/photos/tgirvin/

Google: http://www.google.com/profiles/timgirvin

LinkedIn: http://www.linkedin.com/in/timgirvin

Facebook: http://www.facebook.com/people/Tim-Girvin/644114347

Facebook Page: http://www.facebook.com/pages/Seattle-WA/GIRVIN/91069489624

Twitter: http://twitter.com/tgirvin